South Park Condo Market Snapshot – February 2026

By Michael Robleto, Realtor @ Compass

I’ve lived in South Park since 2009 and track our condo market closely as part of my day-to-day work. Beginning this month, I’ll be including a short, data-focused snapshot in each SPNA newsletter so owners and renters alike can see what is actually happening inside our neighborhood boundaries.

Here’s where we stand.

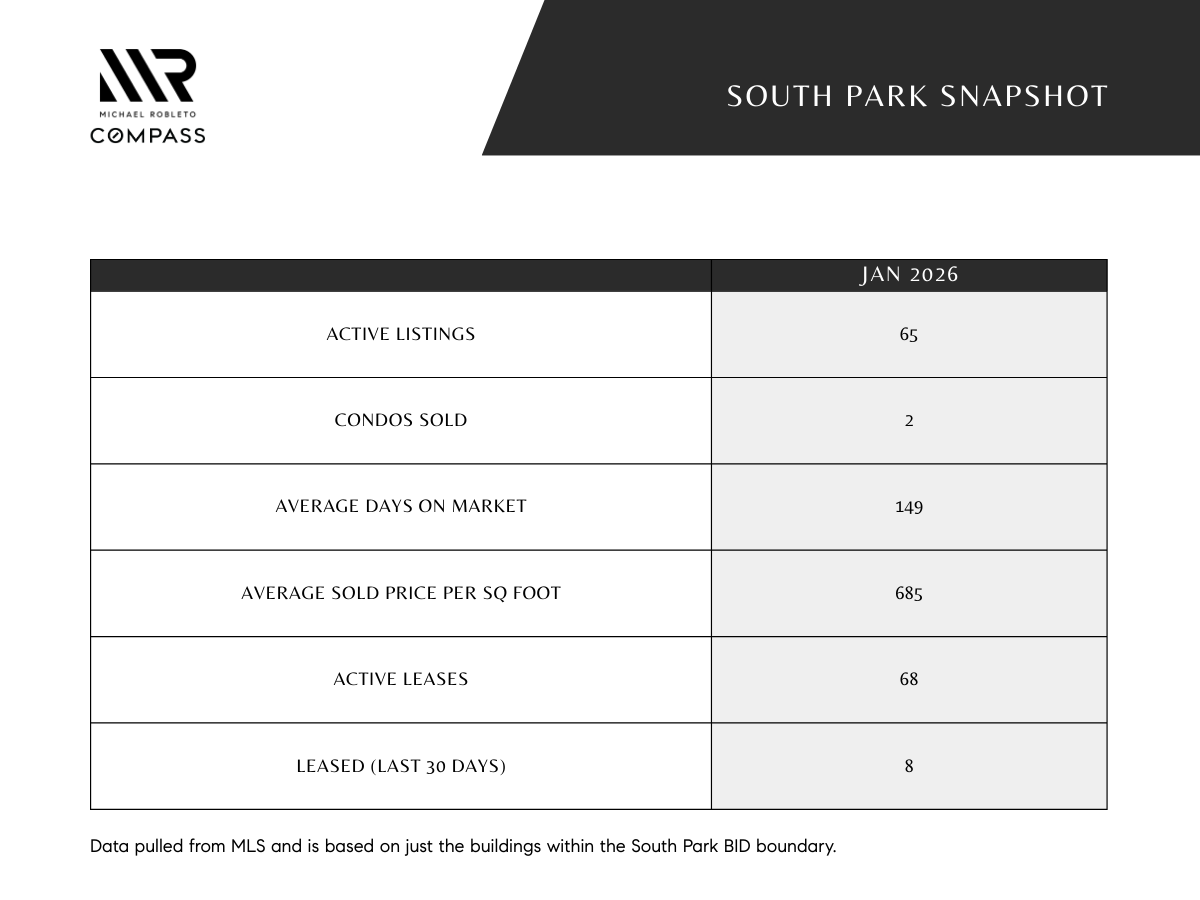

There are currently 65 active condo listings in South Park. In the past 30 days, two units have closed. For context, most of 2025 saw between five and nine sales per month, with an occasional spike higher, although last January had only three units sell. Two closings is not zero, but it is very slow.

Recent sales averaged 149 days on market, the highest reading in the past year and well over the 77 days it was last January. This tells us buyers are hesitant when it comes to investing in DTLA. For all current active listings the average days on market is 104. This is a very slow market in comparison to almost any other area in LA County. Buyers have time. Sellers need to price with precision.

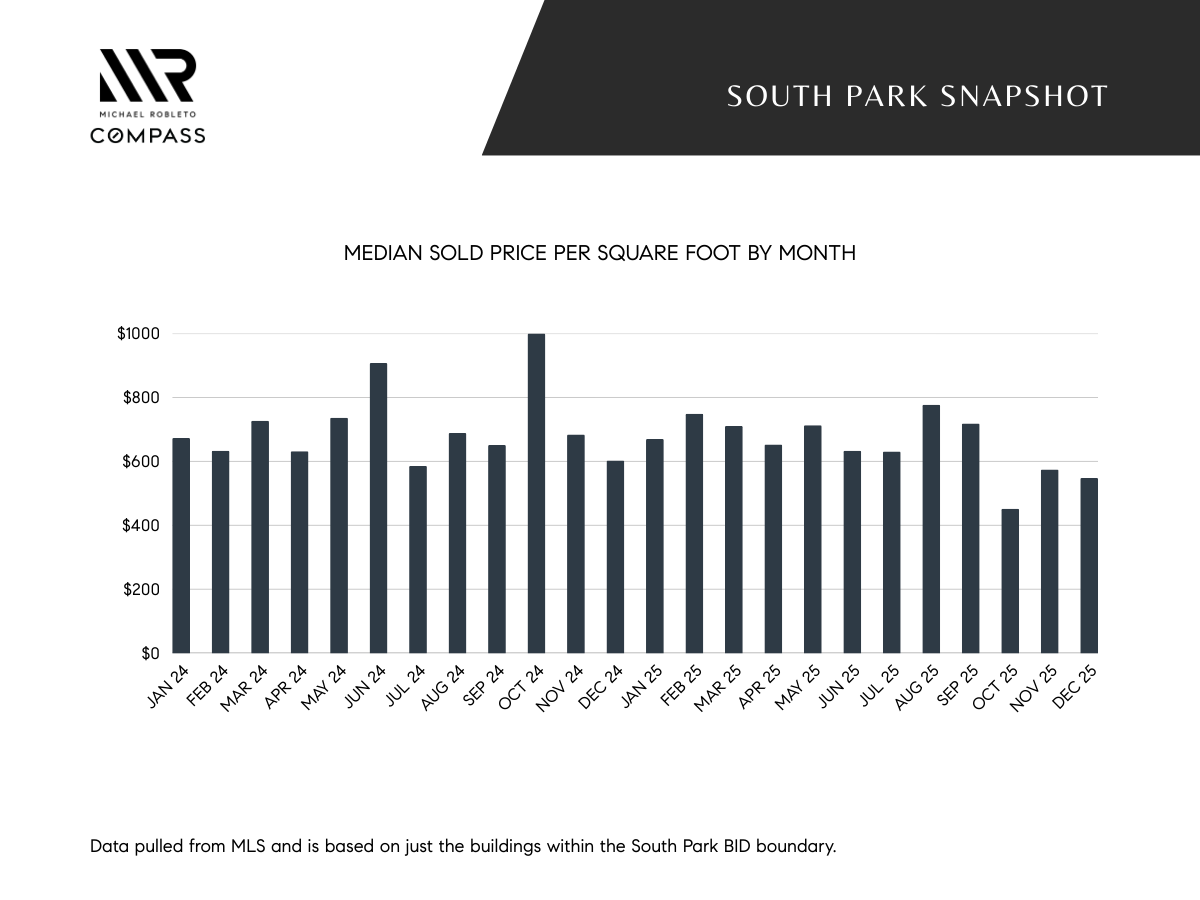

When we look at the average price per square foot (PPSF) we see a compelling story. The average sold PPSF for January was $684 per square foot; for active listings the PPSF is over $721. The buyer pool for South Park condos is very shallow and those in that pool are very price sensitive. The fact is PPSF has been trending down since 2024.

On the leasing side, the numbers require context. There are currently 68 active lease listings; eight units leased in the past 30 days. That is functioning activity, but it is below much of last year’s monthly pace, when leasing volume routinely ran in the mid-teens and higher.

Part of the slowdown is likely increased competition. The newly delivered 550+ unit rental building at Olympic and Hill began leasing in July and was reportedly about 70 percent absorbed by late December. That represents hundreds of new units entering the market in a short period of time. Purpose-built rentals compete aggressively on concessions, amenities, and on-site leasing teams. That pressure affects privately owned condo units.

Leased units are still moving when priced correctly, but the margin for error is thin. Owners considering a lease strategy should assume a competitive environment and price it accordingly.

What does this mean?

For owners, liquidity has slowed. That does not mean values have collapsed. It means strategy matters more than it did when absorption was stronger. Pricing correctly at launch is critical. Chasing the market is expensive. Every building in the district is valued differently and floor height, view, and layout are huge factors. There is a small handful of great agents who specialize in South Park; they will be the best sources for accurate pricing evaluations.

For renters watching the market, conditions are more in their favor than they’ve been in recent years. There is inventory to evaluate, negotiation cycles are longer, and sellers are not dictating terms the way they once did.

I am concerned about the slowdown in velocity, because liquidity is what keeps a vertical neighborhood healthy. At the same time, this is not a distress environment. It is a recalibration.

Each month, I’ll continue tracking inventory, sales volume, days on market, price per square foot, and leasing velocity so we can see whether this is a temporary pause or a longer shift.

South Park is a micro-market. Building quality, HOA strength, and unit positioning matter more here than citywide headlines. If you are evaluating whether to sell, lease, or buy within the neighborhood, informed strategy makes a measurable difference.

Michael Robleto

michael.robleto@compass.com

213-595-4720

Realtor @ Compass

South Park Resident Since 2009

SPNA Board of Directors