Downtown LA Condos: Price Per Square Foot, State of the Market

Downtown Los Angeles — the city’s true urban core — has weathered more than its share of ups and downs since the loft renaissance of the early 2000s. This year, however, has been one of the toughest sales seasons in recent memory. What is usually a busy spring and summer simply didn’t materialize. Condo sales across DTLA dropped nearly 20%, listings spiked by 30%, and units sat on the market three times longer than average. For both agents and sellers, it’s been a head-scratcher.

But DTLA isn’t alone. Sales have lagged across Los Angeles County, with many buyers sitting on the sidelines for a mix of reasons: high interest rates in the sixes, political uncertainty, even the lingering perception that downtown is “less safe.” Add in media coverage that loves to paint DTLA as a war zone, and you can see why buyers have hesitated.

The reality, though, is different on the ground. As a downtown resident, I see the new developments rising, luxury apartments leasing up, and encampments slowly shrinking. Olympic + Hill — the new ONNI tower — hit 60% leased in just two months. The energy we all remember from 2018 is starting to flicker again.

That’s why I wanted to look deeper. Is downtown really in trouble? Or is this a temporary dip? The best way to answer is always the same: go to the data.

Sales Trends: The Big Picture

Annual condo sales in DTLA tell a clear story:

2022: 361 units sold

2023: 245 units sold

2024: 212 units sold

2025: 141 units sold (as of September 23rd)

That’s a 50% drop since 2022. At the same time, listings are up 37%. It’s the classic setup for a buyer’s market: more supply, less demand.

And yet — lower sales don’t automatically mean falling prices. To test that, I turned to one of the most useful metrics in real estate: Price Per Square Foot (PPSF).

Why PPSF Matters

Downtown is a patchwork of neighborhoods and building types. You can find a 400-square-foot starter loft in the Historic Core, or a 3,000-square-foot penthouse with a concierge in the Arts District. Prices range from $400,000 to over $5 million.

That kind of variety makes direct comparisons tricky. PPSF levels the playing field by measuring price against size. It’s not perfect, but it’s one of the best ways to track true market movement.

So, I pulled historic PPSF data — going back to when most of these buildings were first sold in the mid-2000s — and charted the trends. The result tells the story of Downtown LA more clearly than any headline.

Building Snapshots

With 40 condo buildings and some 6,000 units, time wouldn’t allow for an analysis of all the buildings, so I selected the buildings I am most familiar with and for which I have active listings.

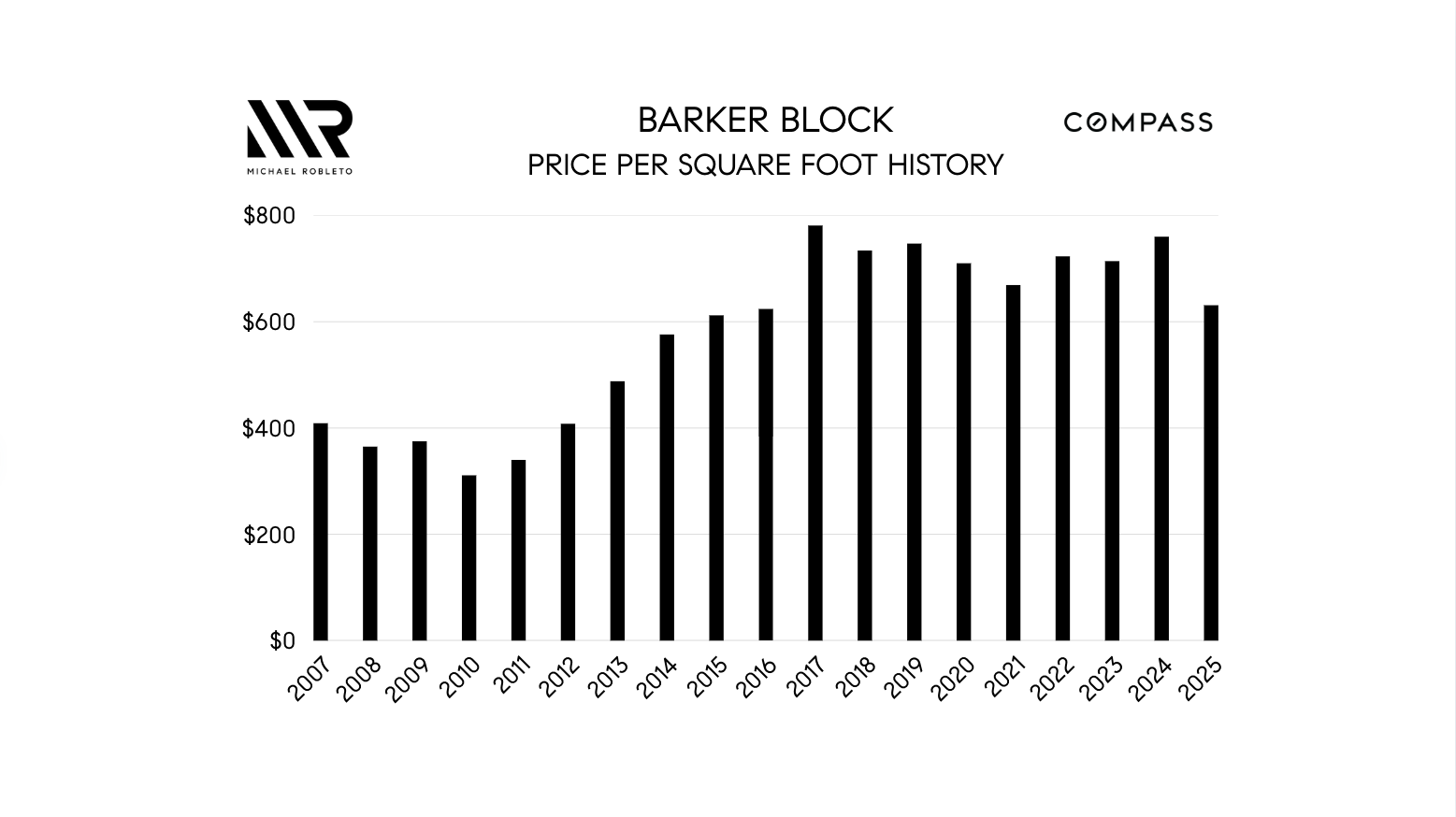

Barker Block – Arts District

When Barker Block first sold in 2007, units averaged around $400 per square foot. Prices dipped sharply during the Great Recession, didn’t recover to original values until 2012, then surged in 2017 at the height of DTLA’s popularity. Since then, the building has ridden the same rollercoaster as the rest of the market: a dip before and during the pandemic, recovery in 2024, and then another sharp decline in 2025 (see chart).

Takeaway: Like a car driven off the lot, new lofts often see a drop right after the first sale. Long term, though, values have proven resilient.

Biscuit Lofts – Arts District

One of my favorites — and one of the most iconic historic conversions in DTLA. A former Nabisco factory turned loft building, Biscuit is on the National Register of Historic Places and benefits from the Mills Act, which cuts property taxes by 50%-70%.

The PPSF trend here started near $600 in 2007, dipped like the others through 2013, spiked in 2017, and then grew steadily until 2024. A few record-setting sales last year skewed averages upward, but 2025 has brought another reset (see chart).

Takeaway: Biscuit remains one of the strongest long-term performers thanks to its architecture, tax advantages, and limited inventory.

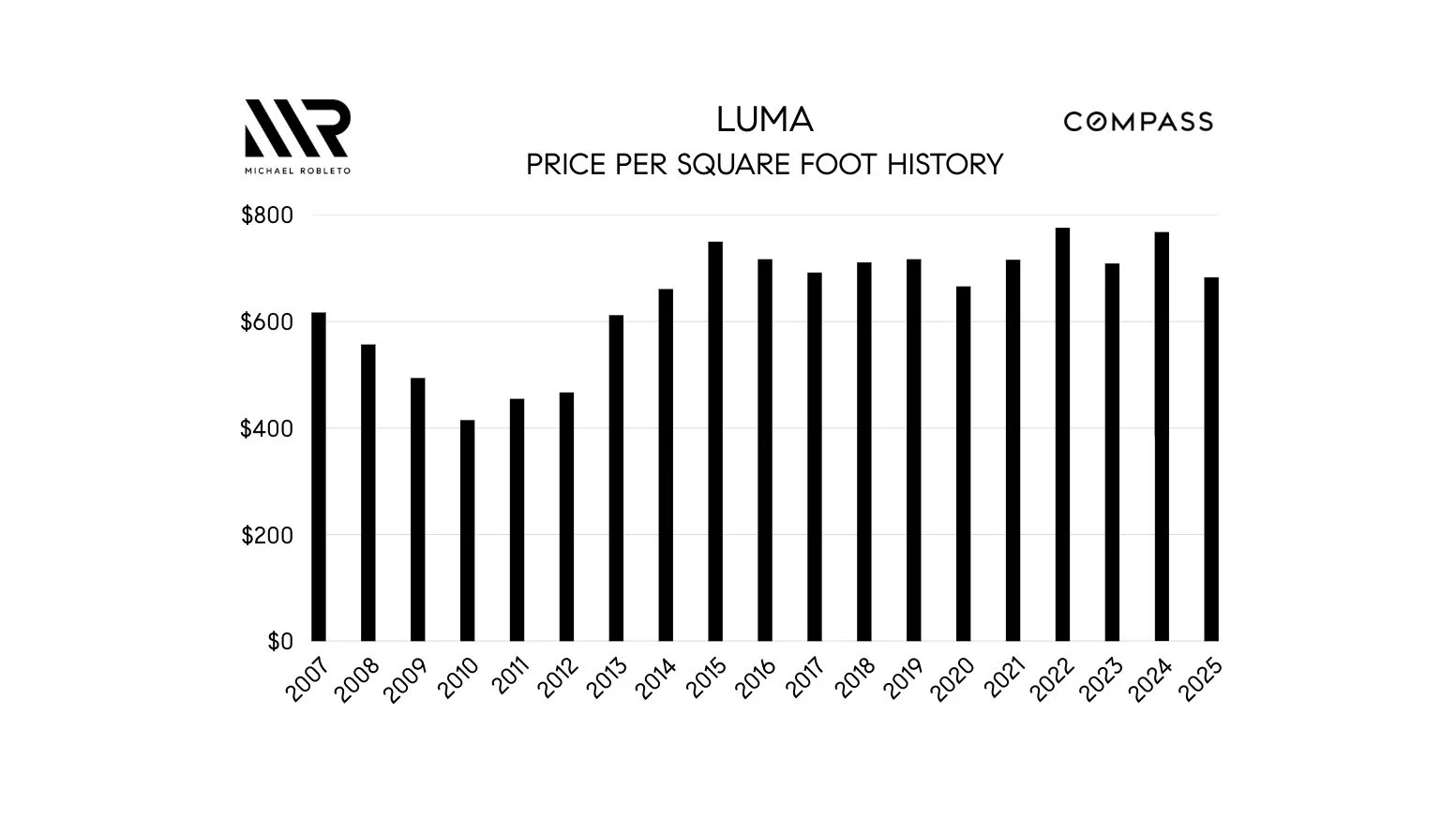

Luma – South Park

A modern high-rise with LEED certification and a lively South Park location. Units here debuted around $600 PPSF, saw the typical drop through 2013, and then held steady until this year. Current prices have slipped back to 2020 levels (see chart).

Takeaway: Luma is a good example of how even newer, well-managed buildings aren’t immune to the broader slowdown — but resets like this often mark buying opportunities.

The Rowan – Historic Core

Built in 1912 and rich with history, Rowan sits just steps from the Skid Row border. I expected a sharper decline here, but the data shows values held fairly steady early on. Since peaking in 2018, however, Rowan’s PPSF has drifted downward almost without pause (see chart).

Takeaway: The grit of the Historic Core weighs on values, but when the neighborhood improves — and it will — Rowan could be poised for outsized appreciation.

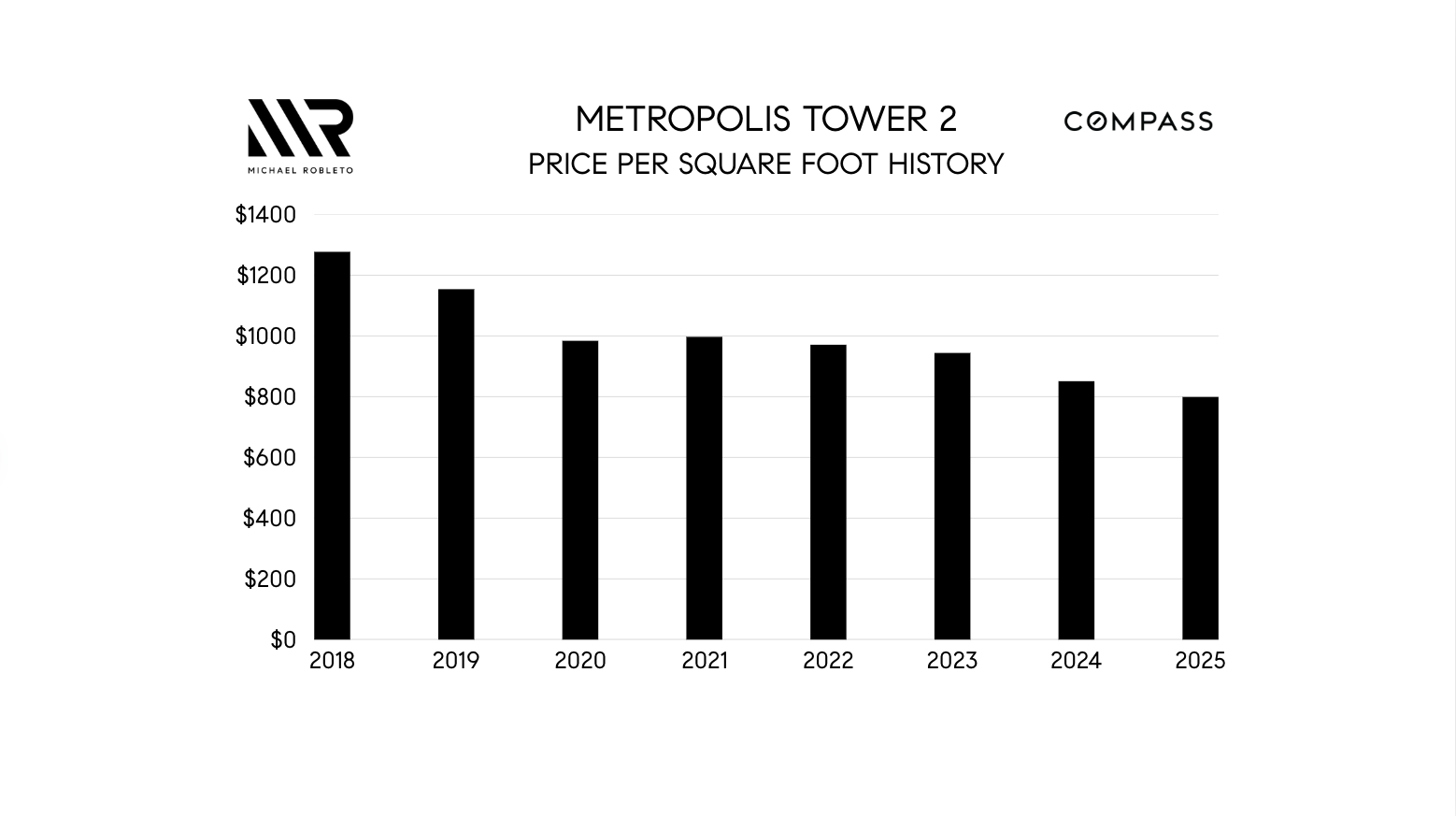

Metropolis Tower 2 – Financial District

The newest of the group, Metropolis offers one of the most impressive amenity decks in the city. Yet despite debuting in 2018, nearly half of its 514 units never sold, and litigation over construction defects has hung over the building (a normal process, expected to resolve by late 2025).

PPSF has been sliding since launch — a longer decline than other buildings, which typically bottom after five years (see chart).

Takeaway: Metropolis is still finding its footing. For patient buyers, it could represent deep value once the litigation cloud clears.

What the Numbers Say

Across these five buildings, a pattern emerges:

Many have reset to 2015-level pricing.

Spikes in 2017 and steady gains into 2019 were followed by dips during the pandemic.

The recent 2025 declines bring PPSF back to levels we haven’t seen in nearly a decade.

In other words, if you could go back in time and buy in 2015, you’d jump at the chance. Today’s market is giving buyers that same opportunity.

The Bigger Picture: Where DTLA Is Heading

Rates are holding around 6.25% as of August 2025. Until they fall, expect values to remain soft. But rates will come down — whether through a Fed leadership change or gradual policy shifts. When they do, prices will climb.

Meanwhile, the future of DTLA looks bright:

Olympics 2028 will put downtown on the world stage.

World Cup 2026 and the approved Convention Center expansion will bring activity and investment.

Stalled projects like Oceanwide (the so-called “Graffiti Towers”) will be forced forward.

Add in consistently strong rental demand — with most apartment towers 95%+ occupied — and the long-term outlook for condos is solid.

What It Means for Sellers

If you bought early, you’re likely still up. If you bought more recently, your gains may be slimmer. Holding until spring could help, but circumstances don’t always allow that. Renovations, views, and floor level can swing value by tens of thousands.

Every unit is unique, and data by building is the key. I can pull specifics for your property to help you understand what the market will bear today.

What It Means for Buyers

This is one of the few true buyer’s markets in Southern California. Longer days on market and less competition mean you can negotiate below list price — something nearly unheard of in other LA neighborhoods.

If you’ve been waiting for a chance to buy into downtown, this is it. The fundamentals are still strong, the community is vibrant, and the reset in PPSF creates real opportunity.

Final Thoughts

DTLA isn’t dead. Far from it. The market is adjusting, and for buyers, that’s the opening you’ve been waiting for. For sellers, the key is understanding your building’s specific PPSF trends and positioning your unit smartly.

I’ve been analyzing this data building by building for years, and I’d be glad to pull the numbers for your property or your target search.

Thinking about buying or selling a downtown condo? Reach out — let’s dig into the data and see what’s possible for you.

By Michael Robleto

Compass Real Estate

michael.robleto@compass.com